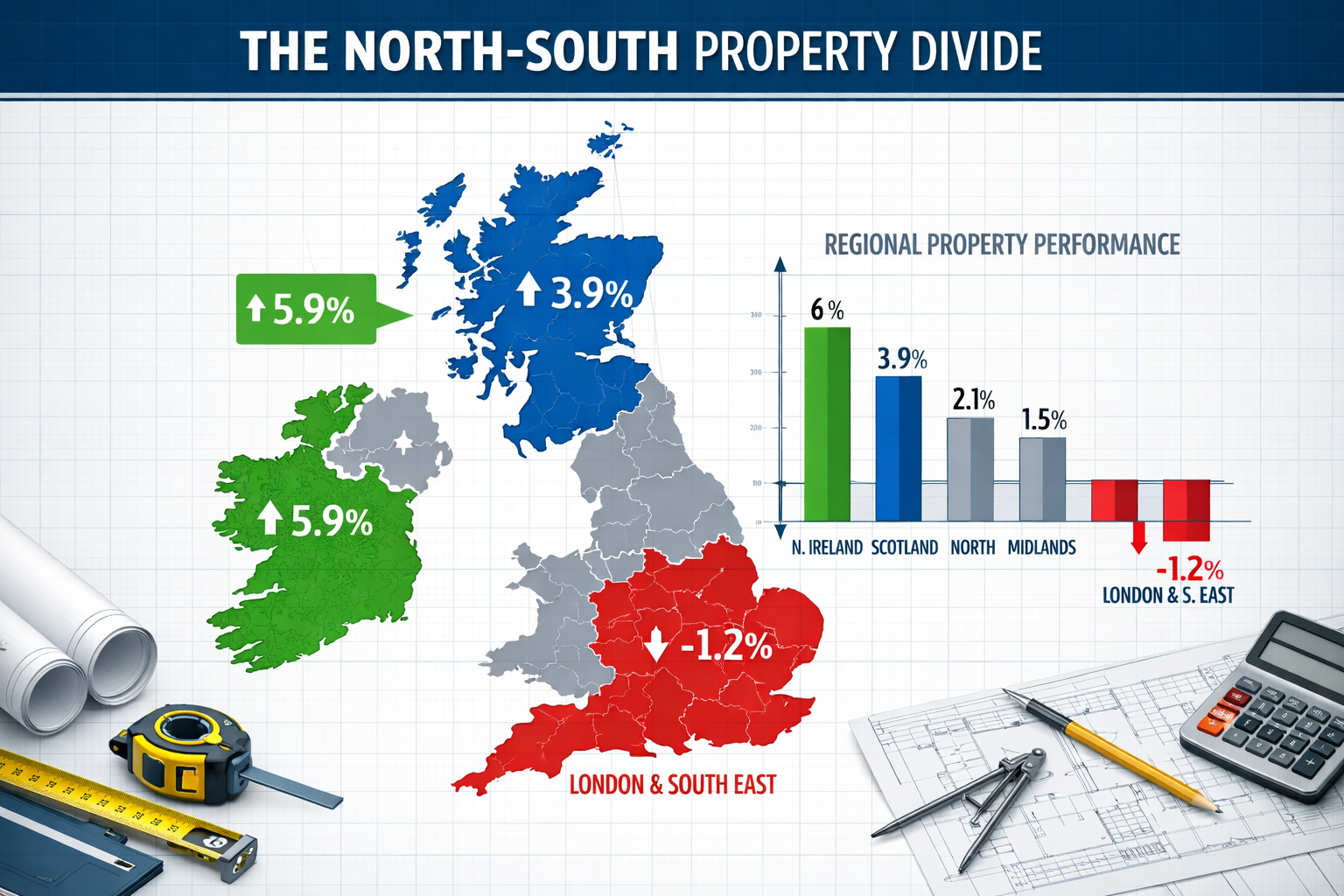

The UK property market is experiencing an unprecedented regional divide in 2026. While London and the South East struggle with declining values, Northern Ireland and Scotland are witnessing remarkable growth that demands a fundamental rethinking of how surveyors approach property valuations. Recent RICS data reveals that Valuation Surveys Across Regional Divides: Why Northern Ireland and Scotland Require Different Appraisal Strategies in 2026 has become a critical consideration for professionals navigating these divergent market dynamics.

This stark contrast presents both challenges and opportunities for property professionals. Understanding why these regions require distinct appraisal methodologies is essential for delivering accurate, reliable valuations in today's fragmented market landscape.

Key Takeaways

✅ Northern Ireland leads UK growth with residential property prices rising 5.9-7.5% annually, while non-domestic valuations increased 15% overall in the 2026 revaluation[1][3]

✅ Scotland demonstrates sustained stability with 3.9-5.4% annual residential growth and 12.23% increase in non-domestic property valuations, supported by softer mortgage rates[1][5]

✅ Southern markets face affordability pressures with London, South East, South West, and Eastern England recording annual declines exceeding 1%[1]

✅ Evidence base timing creates challenges as valuations use rental data from April 2024 but take effect April 2026, potentially affecting accuracy in rapidly changing markets[3][6]

✅ Sector-specific variations demand nuanced approaches with office and retail sectors showing different growth patterns between regions and within subsectors[3]

Understanding the North-South Property Divide in 2026

The geographical polarization of the UK property market has reached new heights in 2026. The performance gap between northern and southern regions represents more than just statistical variation—it reflects fundamental differences in economic conditions, affordability, and market dynamics that surveyors must account for when conducting RICS property valuations.

The Numbers Behind the Divide

Northern Ireland has emerged as the strongest performing region in the UK, with average residential property prices reaching £217,206 to £221,062—representing annual growth of 5.9% to 7.5%[1][2]. Scotland follows closely with average prices of £217,775 to £221,711 and annual growth rates between 3.9% and 5.4%[1][2].

In stark contrast, southern markets tell a different story:

| Region | Annual Price Change | Market Condition |

|---|---|---|

| Northern Ireland 🟢 | +5.9% to +7.5% | Strong growth |

| Scotland 🟢 | +3.9% to +5.4% | Steady growth |

| South East 🔴 | -1% or more | Declining |

| South West 🔴 | -1% or more | Declining |

| London 🔴 | -1% or more | Declining |

| Eastern England 🔴 | -1% or more | Declining |

This divergence stems from higher borrowing costs and affordability pressures that disproportionately affect southern markets where property prices remain significantly elevated[1]. For surveyors, these contrasting conditions require fundamentally different analytical frameworks and valuation approaches.

Recovery Narratives vs. Sustained Stability

Understanding the why behind regional performance is crucial for accurate appraisals. Northern Ireland's impressive growth reflects "recovery from a low base and a more stable economic and political backdrop"[2]. Despite recent gains, property prices in Northern Ireland remain approximately 5% below 2007 peaks[2], indicating room for continued appreciation as the region catches up to historical benchmarks.

Scotland's performance, meanwhile, represents sustained market stability rather than recovery. When compared to 2005 benchmarks, Scotland's property prices have appreciated 3.7% annually in real terms, while Wales and Northern Ireland show property values lower in real terms despite nominal gains[2]. This historical perspective reveals Scotland's market maturity and suggests different long-term valuation considerations.

"Scotland's property market benefits from softer mortgage rates and anticipated base rate cuts expected to support affordability and continued modest price growth into 2026."[2]

Why Valuation Surveys Across Regional Divides: Northern Ireland's Unique Market Characteristics

Northern Ireland's property market presents distinctive challenges that demand specialized appraisal strategies. The 2026 revaluation cycle—known as Reval 2026—provides crucial insights into how surveyors must adapt their methodologies for this rapidly evolving market.

The Reval 2026 Framework

Land & Property Services published the draft valuation list for Reval 2026, revealing an overall growth of 15% across all non-domestic property sectors[3]. This substantial increase is based on rental evidence from April 2024, with new rateable values taking effect on 1 April 2026[3][6].

This evidence base timing creates a critical consideration for surveyors: the two-year lag between data collection and implementation may affect accuracy in rapidly changing markets. Property professionals conducting building evaluations must account for this temporal disconnect when advising clients on valuation expectations.

Sector-Specific Performance in Northern Ireland

The Northern Ireland market demonstrates significant subsector differentiation that requires granular analysis:

Office Sector Performance 📊

Office property values increased approximately 9%, driven largely by Grade A offices concentrated in Belfast[3]. This growth reflects the capital's emergence as a competitive business hub, but surveyors must recognize that this performance doesn't extend uniformly across the region. Secondary locations and lower-grade office stock may show markedly different trajectories.

Retail Sector Dynamics 🏪

Retail property values rose approximately 9% compared to the previous revaluation, with stronger growth in Belfast and more moderate increases elsewhere[3]. However, independent high street retailers may see no valuation changes despite the overall 9% retail growth[3]. This disparity highlights the importance of property-specific analysis rather than relying on sector-wide averages.

Implications for Valuation Methodology

These characteristics necessitate several strategic adjustments for Northern Ireland valuations:

- Location-specific weighting: Belfast-centric growth patterns require careful consideration of geographical positioning within the region

- Subsector granularity: Broad sector classifications insufficient; property-specific characteristics must drive valuation conclusions

- Recovery trajectory analysis: Understanding the property's position relative to 2007 peaks provides essential context

- Evidence base recency: The April 2024 evidence date requires current market condition overlays for 2026 valuations

When conducting property assessments in Northern Ireland, surveyors must balance standardized methodologies with these region-specific factors to deliver accurate, defensible valuations.

Why Valuation Surveys Across Regional Divides: Scotland's Distinct Appraisal Requirements

Scotland's property market operates under different regulatory frameworks, market conditions, and growth drivers than Northern Ireland, demanding equally specialized but fundamentally different valuation approaches. The Scottish Assessors Association published the draft 2026 valuation roll statistics, revealing market dynamics that distinguish Scotland from other UK regions.

The 2026 Valuation Roll Framework

Non-domestic property valuations in Scotland increased 12.23% in the 2026 draft valuation roll, effective 1 April 2026[5]. While this represents substantial growth, it's notably lower than Northern Ireland's 15% overall increase—a difference that reflects Scotland's more mature market position rather than weaker performance.

The Scottish revaluation system operates with its own distinct legislative framework and assessment methodologies that surveyors must master. Unlike Northern Ireland's approach, Scottish valuations incorporate different evidence hierarchies and adjustment factors specific to Scottish property law and market conventions.

Market Stability and Mortgage Accessibility

Scotland's 3.9% to 5.4% annual residential growth[1][2] occurs against a backdrop of favorable financing conditions. The market benefits from softer mortgage rates and anticipated base rate cuts expected to support affordability and continued modest price growth into 2026[2].

This financing advantage creates a fundamentally different valuation context than Northern Ireland's recovery narrative. Scottish property values reflect:

- Sustained demand rather than catch-up growth

- Affordability advantages compared to southern UK markets

- Stable lending conditions supporting consistent appreciation

- Long-term appreciation trends evidenced by 3.7% annual growth since 2005[2]

Regional Variations Within Scotland

Scotland's property market exhibits significant internal geographical variation that surveyors must navigate:

Urban Centers 🏙️

Edinburgh and Glasgow drive much of Scotland's commercial property growth, with premium office space and retail locations showing strongest performance. These markets operate at different price points and growth rates than secondary Scottish cities.

Secondary Markets 🏘️

Aberdeen, Dundee, and other regional centers demonstrate different dynamics influenced by local economic conditions, particularly Aberdeen's sensitivity to energy sector performance.

Rural and Remote Areas 🏞️

Highland and island properties require specialized valuation approaches accounting for limited comparables, seasonal demand factors, and unique property characteristics.

Methodological Adaptations for Scottish Valuations

Effective Scottish property valuations require several strategic considerations:

- Regulatory compliance: Understanding Scottish-specific valuation legislation and assessment methodologies

- Market maturity recognition: Acknowledging Scotland's established growth trajectory versus recovery-phase markets

- Geographical stratification: Applying appropriate location-based adjustments within Scotland's diverse property landscape

- Financing context: Incorporating mortgage accessibility and rate expectations into value projections

When preparing RICS building surveys in Scotland, professionals must integrate these Scotland-specific factors while maintaining consistency with broader RICS standards and best practices.

Comparative Analysis: Why Different Strategies Matter for Valuation Surveys Across Regional Divides

The divergent market conditions in Northern Ireland and Scotland versus southern UK regions create scenarios where one-size-fits-all valuation approaches fail. Understanding these differences isn't merely academic—it has direct implications for property transactions, financing decisions, and investment strategies.

Evidence Base and Timing Considerations

Both Northern Ireland and Scotland utilize rental evidence from April 2024 for valuations taking effect in April 2026[3][5][6]. This standardized evidence date creates a temporal challenge across both regions, but the implications differ based on market velocity.

In Northern Ireland's faster-growing market, the two-year lag potentially understates current values, particularly in high-performing Belfast commercial sectors. Surveyors must consider whether the 15% overall increase adequately captures ongoing appreciation[3].

In Scotland's more stable market, the evidence lag presents less distortion risk, as the 12.23% increase reflects steady, predictable growth patterns[5]. However, anticipated base rate cuts could accelerate appreciation beyond evidence-period projections[2].

Sector Performance Divergence

The commercial property sectors demonstrate markedly different characteristics between regions:

| Sector | Northern Ireland | Scotland | Valuation Implication |

|---|---|---|---|

| Grade A Offices | ~9% growth, Belfast-concentrated[3] | Strong urban center performance | Location premium critical |

| Retail | ~9% overall, but independent retailers unchanged[3] | Variable by location type | Subsector analysis essential |

| Overall Commercial | 15% increase[3] | 12.23% increase[5] | Different baseline expectations |

These variations require surveyors to adjust comparable selection criteria based on region. A Belfast Grade A office comparable may be inappropriate for an Edinburgh property despite similar use classifications, due to different market dynamics and growth drivers.

Affordability and Borrowing Cost Impacts

The affordability divide between northern and southern UK markets fundamentally alters valuation risk assessments:

Northern Ireland advantages:

- Lower absolute price points enable stronger buyer demand

- Recovery from below-peak levels suggests upside potential

- Stable political backdrop supports confidence[2]

Scotland advantages:

- Softer mortgage rates enhance affordability[2]

- Anticipated base rate cuts support continued growth[2]

- Historical appreciation demonstrates market resilience[2]

Southern market challenges:

- Higher borrowing costs constrain demand[1]

- Elevated price points limit buyer pools

- Negative annual growth creates downside risk[1]

When conducting RICS homebuyer surveys, these regional affordability factors should inform value opinions and risk assessments, particularly for properties at the upper end of local price ranges.

Recovery vs. Stability: Different Valuation Lenses

Perhaps the most fundamental distinction lies in the market narrative underpinning each region's performance:

Northern Ireland's Recovery Lens 🔄

Valuations must consider:

- Distance from 2007 peak values (currently ~5% below)[2]

- Potential for continued catch-up appreciation

- Economic and political stability as enabling factors[2]

- Lower base creating percentage growth advantages

Scotland's Stability Lens ⚖️

Valuations must consider:

- Established long-term appreciation trends (3.7% annually since 2005)[2]

- Market maturity suggesting sustainable but moderate growth

- Financing advantages supporting steady demand

- Real-term value preservation over extended periods[2]

These different lenses affect future value projections, risk assessments, and advice provided to clients regarding optimal transaction timing and pricing strategies.

Practical Applications: Implementing Region-Specific Valuation Strategies

Translating regional market understanding into actionable valuation practices requires systematic methodology adjustments. Professional surveyors must develop region-specific frameworks while maintaining consistency with RICS standards and professional obligations.

Comparable Selection and Adjustment

For Northern Ireland valuations:

- Prioritize comparables from same subsector (e.g., Grade A vs. Grade B offices)

- Apply geographical adjustments for Belfast vs. regional locations

- Consider temporal adjustments accounting for rapid appreciation since April 2024 evidence date

- Weight recent transactions more heavily given accelerating growth trajectory

For Scotland valuations:

- Emphasize comparable quality and location matching within Scottish urban hierarchy

- Apply moderate temporal adjustments reflecting steady appreciation patterns

- Consider financing condition changes since comparable transaction dates

- Balance urban center comparables with secondary market evidence appropriately

Risk Assessment and Reporting

Different regional dynamics require tailored risk disclosure in valuation reports:

Northern Ireland risk factors:

- Political stability maintenance as growth prerequisite

- Sustainability of recovery trajectory as prices approach historical peaks

- Concentration risk in Belfast-driven sectors

- Evidence base lag in rapidly appreciating markets

Scotland risk factors:

- Base rate trajectory impacts on mortgage-dependent demand

- Urban-rural performance divergence

- Sector-specific variations within stable overall market

- Long-term sustainability of financing advantages

When preparing reports following specific defect surveys, these regional risk factors should inform both the valuation conclusion and the commentary provided to clients.

Advice for Different Client Types

Buyers in Northern Ireland 🏠

- Consider recovery trajectory when evaluating purchase timing

- Assess property-specific positioning within subsector performance

- Evaluate location premium for Belfast vs. regional properties

- Factor potential for continued appreciation toward historical peaks

Buyers in Scotland 🏠

- Recognize stable, sustainable growth patterns

- Consider financing advantages in affordability calculations

- Evaluate long-term appreciation potential based on historical trends

- Assess geographical positioning within Scottish urban hierarchy

Sellers in both regions 💼

- Understand evidence base timing when setting pricing expectations

- Recognize subsector-specific performance variations

- Consider transaction timing relative to revaluation effective dates

- Leverage regional growth narratives in marketing positioning

Negotiation Support and Price Reduction Strategies

Regional market conditions significantly impact negotiating the purchase price after a building survey:

In appreciating Northern Ireland and Scotland markets:

- Defects carry less negotiating weight in strong demand conditions

- Buyers have less leverage for significant reductions

- Focus negotiations on critical structural issues rather than cosmetic items

- Consider repair cost offsets rather than percentage-based reductions

In declining southern markets:

- Survey findings provide stronger negotiation leverage

- Buyers can more readily secure price reductions

- Sellers more motivated to accommodate reasonable adjustment requests

- Market conditions support more aggressive negotiation strategies

Understanding these regional dynamics helps surveyors provide realistic advice about what to do after a bad building survey report and achievable negotiation outcomes.

Professional Standards and Regional Compliance

Maintaining professional standards while adapting to regional variations requires careful navigation of regulatory frameworks and professional obligations. RICS standards provide overarching principles, but regional application demands nuanced understanding.

RICS Red Book Compliance Across Regions

The RICS Valuation – Global Standards (Red Book) establishes mandatory requirements for all RICS members conducting valuations. When considering Red Book valuations, surveyors must ensure regional adaptations don't compromise core standards:

Universal Red Book requirements:

- Competence and objectivity

- Clear terms of engagement

- Appropriate valuation approaches and methods

- Transparent assumptions and special assumptions

- Comprehensive reporting

Regional application considerations:

- Evidence selection reflecting regional market characteristics

- Adjustment factors appropriate to local conditions

- Risk disclosures addressing region-specific factors

- Market commentary incorporating regional dynamics

Valuation Uncertainty and Market Conditions

The divergent regional markets create different levels of valuation uncertainty that must be appropriately disclosed:

Lower uncertainty contexts:

- Stable markets with abundant comparable evidence

- Established appreciation trends with predictable trajectories

- Mature financing markets with consistent lending practices

Higher uncertainty contexts:

- Rapidly changing markets with limited recent comparables

- Recovery-phase markets with unclear sustainability

- Evidence base timing lags in accelerating markets

Northern Ireland's rapid growth and recovery narrative may warrant material valuation uncertainty clauses in certain circumstances, particularly for property types with limited comparable evidence. Scotland's stable market typically presents lower uncertainty, though anticipated policy changes (base rate cuts) should be noted.

Cross-Border Considerations

Surveyors operating across UK regions must maintain methodological consistency while adapting to regional characteristics:

- Standardized reporting templates with region-specific commentary sections

- Consistent comparable analysis frameworks with regional adjustment factors

- Uniform risk assessment approaches applied to region-specific risk factors

- Transparent disclosure of regional methodology variations

This approach ensures clients receive comparable service quality regardless of property location while benefiting from region-specific expertise.

Future Outlook: Evolving Strategies for 2026 and Beyond

The regional dynamics shaping Valuation Surveys Across Regional Divides: Why Northern Ireland and Scotland Require Different Appraisal Strategies in 2026 continue to evolve. Forward-looking surveyors must anticipate market trajectory changes and adapt methodologies accordingly.

Anticipated Market Developments

Northern Ireland trajectory:

- Continued recovery toward 2007 peak levels

- Potential moderation as prices approach historical benchmarks

- Ongoing Belfast concentration in commercial sectors

- Political stability maintenance as critical variable

Scotland trajectory:

- Sustained modest growth supported by financing advantages

- Base rate cuts potentially accelerating appreciation[2]

- Continued urban-rural performance divergence

- Long-term stability suggesting predictable patterns

Southern market recovery potential:

- Affordability improvements if base rates decline

- Potential stabilization following current correction phase

- London and South East recovery dependent on economic conditions

- Possible narrowing of north-south divide over medium term

Revaluation Cycle Implications

The next revaluation cycles will incorporate 2026-2028 rental evidence, potentially capturing:

- Northern Ireland's approach toward historical peak values

- Scotland's response to base rate policy changes

- Southern market stabilization or continued decline

- Sectoral performance shifts post-2026

Surveyors should anticipate methodology refinements as these new evidence periods provide fresh market insights and potentially different growth patterns.

Technology and Data Integration

Advancing valuation practices through technology adoption offers opportunities for enhanced regional analysis:

Data analytics applications:

- Automated comparable selection with regional filtering

- Predictive modeling incorporating region-specific variables

- Real-time market monitoring for evidence base updates

- Geographical information systems for location analysis

Regional market intelligence:

- Subscription data services with regional granularity

- Transaction databases with regional filtering capabilities

- Economic indicator tracking for regional forecasting

- Rental evidence aggregation for revaluation preparation

Professional Development Priorities

Surveyors committed to excellence in regional valuation should prioritize:

- Continuous regional market education through local market reports and networking

- Regulatory updates on Northern Ireland and Scottish valuation frameworks

- Comparable database development with regional classification systems

- Client communication skills for explaining regional variations

- Cross-regional experience building through diverse assignment portfolios

Conclusion

The stark reality of Valuation Surveys Across Regional Divides: Why Northern Ireland and Scotland Require Different Appraisal Strategies in 2026 demands that property professionals abandon one-size-fits-all approaches in favor of sophisticated, region-specific methodologies. Northern Ireland's impressive 5.9-7.5% residential growth and 15% non-domestic revaluation increase reflects a recovery narrative fundamentally different from Scotland's stable 3.9-5.4% residential appreciation and 12.23% commercial increase[1][2][3][5].

These divergent market conditions—driven by different financing environments, affordability dynamics, and historical trajectories—require surveyors to develop specialized analytical frameworks for each region. The evidence base timing, subsector variations, and geographical concentrations within each market add further complexity that generic valuation approaches cannot adequately address.

Actionable Next Steps

For surveyors conducting valuations in Northern Ireland and Scotland:

✅ Develop region-specific comparable databases with appropriate geographical and subsector classifications

✅ Implement systematic adjustment protocols accounting for evidence base timing lags and market velocity differences

✅ Enhance risk assessment frameworks to address region-specific factors including recovery sustainability and financing conditions

✅ Strengthen client communication explaining regional market dynamics and their valuation implications

✅ Pursue continuing professional development focused on regional regulatory frameworks and market intelligence

✅ Monitor revaluation outcomes and appeal processes to refine future methodology applications

✅ Build local market networks for enhanced comparable evidence and market insight access

For property buyers and sellers:

✅ Engage surveyors with demonstrated regional expertise rather than generic national firms

✅ Request region-specific market commentary in valuation and survey reports

✅ Consider regional growth trajectories when making transaction timing decisions

✅ Understand subsector positioning of specific properties within regional performance patterns

✅ Factor regional risk profiles into investment and financing decisions

The UK property market's regional fragmentation shows no signs of abating in 2026. Professional surveyors who invest in developing sophisticated, region-specific valuation capabilities will deliver superior client outcomes while positioning themselves as essential advisors in an increasingly complex market landscape.

Whether conducting property valuations in Belfast's recovering commercial market or Edinburgh's stable residential sector, the fundamental principle remains constant: accurate valuations require deep understanding of regional market dynamics, regulatory frameworks, and growth drivers. The divergence between Northern Ireland, Scotland, and southern UK markets makes this regional expertise not merely advantageous—but essential.

For professional guidance on property valuations tailored to specific regional market conditions, get a quote from experienced surveyors who understand the critical importance of region-specific appraisal strategies.

References

[1] North Outpaces South As House Price Divide Widens – https://residentiallandlord.co.uk/north-outpaces-south-as-house-price-divide-widens/

[2] Regional Outlook House Price Performance By Country – https://thenegotiator.co.uk/columns/kate-faulkner/regional-outlook-house-price-performance-by-country/

[3] Land Property Services Publishes Draft Valuation List Reval 2026 – https://www.finance-ni.gov.uk/news/land-property-services-publishes-draft-valuation-list-reval-2026

[4] The 2026 Uk Property Market Outlook – https://nedbankprivatewealth.com/insights/the-2026-uk-property-market-outlook/

[5] Draft 2026 Valuation Roll Statistics – https://www.gov.scot/publications/draft-2026-valuation-roll-statistics/

[6] Help With The 2026 Business Rates Revaluation – https://www.gov.uk/guidance/help-with-the-2026-business-rates-revaluation