In the United Kingdom, a homebuyers survey, classified as a level 2 survey by the Royal Institution of Chartered Surveyors (RICS), offers a more in-depth examination of the property. This detailed inspection is critical for uncovering potential issues, enabling buyers to make good investment decisions.

Such surveys are instrumental in identifying structural defects, dampness, and other hidden problems. They are a crucial component of the homebuying process, potentially averting the need for expensive repairs and renovations. By conducting a homebuyers survey, buyers can negotiate the purchase price or even decide to withdraw from the deal if significant flaws are discovered.

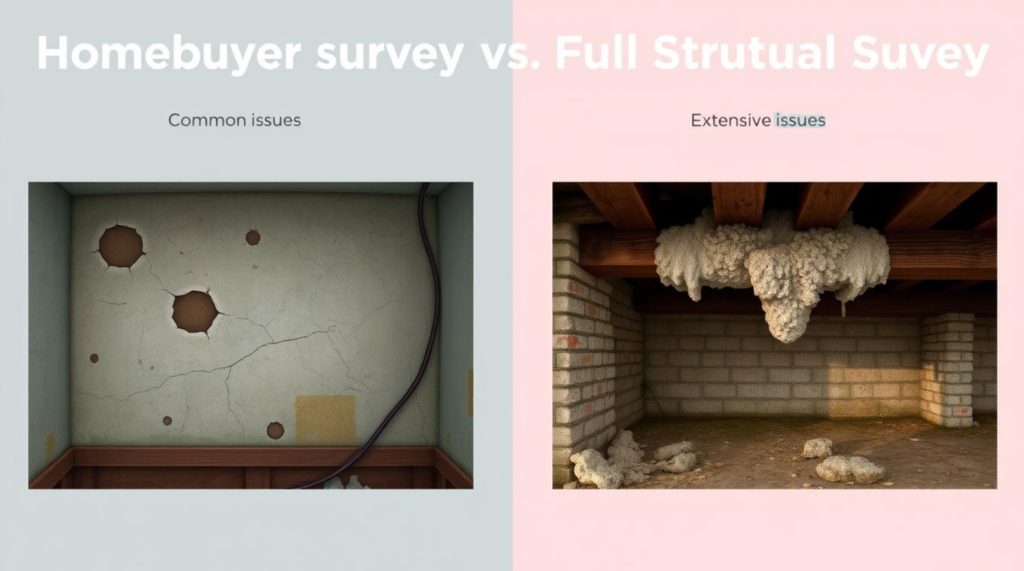

Distinguishing between a homebuyers survey and a full structural survey is paramount. Although both surveys offer benefits, they cater to different needs. A full structural survey provides an exhaustive examination of the property’s structure, foundation, and other essential components. Conversely, a homebuyers survey offers a more general assessment, highlighting potential issues and suggesting further investigations.

Key Takeaways

- A homebuyers survey is a level 2 survey that provides a moderate inspection of the property.

- It is essential to understand the difference between a homebuyers survey and a full structural survey.

- A homebuyers survey can help identify structural concerns, damp and moisture problems, and other issues.

- A property survey can save homebuyers from costly repairs and renovations down the line.

- It is a vital step in the property buying process, as it can help individuals make an informed investment decision.

- A homebuyers survey can be used to negotiate the price of the property or withdraw from the purchase if significant issues are found.

Understanding Property Surveys in the UK Property Market

In the UK, property surveys are pivotal in the buying process. A full structural survey offers a detailed examination of a property’s condition. The Royal Institution of Chartered Surveyors (RICS) is one regulator in the market, ensuring surveys meet high standards. The same can be said for Chartered Institute of Building (CIOB) and Residential Property Surveyors Association (RPSA).

Understanding the various surveys is helpful when buying a property. A full structural survey uncovers potential issues like structural damage or damp. This insight aids in price negotiations or future repair planning.

The Importance of RICS Accreditation

CIOB, RICS and RPSA accreditation signifies a surveyor’s competence and experience. The RICS, for example, sets guidelines and standards for surveys, ensuring surveyors meet their obligations and service expectations.

Benefits of a Full Structural Survey

A full structural survey offers several advantages:

- Identifies potential property issues

- Provides a thorough analysis of the property’s condition

- Assists in negotiating the purchase price

- Facilitates planning for future repairs and maintenance

Grasping the significance of surveys in property buying empowers individuals to make informed choices. A full structural survey ensures peace of mind and prevents unexpected future costs.

What is a Homebuyers Survey?

A homebuyers survey is a level 2 survey, offering a detailed inspection of the property. It examines the property’s condition and identifies any potential defects. This survey is suitable for most residential properties, including flats and houses. The choice between a homebuyers survey or full structural survey hinges on the property’s age, type, and condition.

The benefits of a homebuyers survey are numerous:

- It identifies major defects or issues with the property.

- It advises on necessary repairs or maintenance.

- It assesses the property’s value and potential risks.

This survey offers peace of mind to buyers, enabling them to make informed decisions. Additionally, some lenders may require it as a mortgage condition.

Choosing between a homebuyers survey or full structural survey depends on the property’s needs and the buyer’s requirements. A full structural survey is more comprehensive but pricier. Conversely, a homebuyers survey offers a detailed inspection at a lower cost than a full structural survey.

In conclusion, a homebuyers survey is invaluable for buyers. It provides a detailed understanding of the property’s condition and potential issues. By weighing the benefits and limitations of a homebuyers survey or full structural survey, buyers can make an informed choice.

Complete Guide to Full Structural Surveys

A full structural survey is a level 3 survey, offering a comprehensive examination of a property’s structure and condition. It is crucial for uncovering any potential issues, such as structural damage or defects. Understanding the scope and depth of this investigation, along with the professional qualifications required, is vital.

Scope and Depth of Investigation

The full structural survey encompasses a detailed examination of the property’s structure, including foundations, walls, floors, and roof. It also involves inspecting the property’s services, like electrical and plumbing systems. The investigation’s depth varies based on the property’s specific needs and the client’s requirements. It may include specialized tests, such as thermal imaging or structural calculations.

When Full Structural Surveys Are Essential

A full structural survey is crucial in specific scenarios, such as when purchasing an older property or one that has undergone significant modifications. It is also advisable when there are concerns about the property’s structure or condition. In these cases, a homebuyers survey may not suffice, necessitating a full structural survey to ensure the property’s safety and security.

Key benefits of a full structural survey include:

- Identifying potential issues with the property’s structure or condition

- Providing the most detailed report on the property’s condition and any necessary repairs

- Helping to negotiate the purchase price of the property

By grasping the scope and depth of a full structural survey, along with the situations where it is indispensable, clients can make informed decisions. This ensures they are safeguarded from potential issues when purchasing a property.

Comparing Costs: Homebuyers Survey or Full Structural

When deliberating between a homebuyers survey and a full structural survey, cost emerges as a pivotal consideration. Homebuyers survey costs fluctuate between £600 and £1,500, influenced by the property’s location and type. This disparity stems from the property’s dimensions, age, and state of repair.

A full structural survey, however, offers a more exhaustive evaluation of the property’s condition. It encompasses the structure, foundations, and potential for defects. This level of detail comes at a premium, underscoring the importance of understanding the financial implications of each survey option.

Key factors to ponder when comparing homebuyers survey costs include:

- The cost of a homebuyers survey is generally lower than a full structural survey

- Homebuyers survey costs can vary depending on the location and type of property

- A full structural survey provides a more detailed assessment of the property’s condition

In summary, the financial aspect of homebuyers surveys is critical for prospective property buyers. Grasping the costs associated with each survey enables individuals to make a well-informed choice regarding which survey aligns with their needs.

Timeframes and Duration Expectations

Understanding the timeframes and duration expectations for homebuyers surveys and full structural surveys is paramount. The duration for a homebuyers survey can vary from 1-3 days, influenced by the property’s location and type. This timeframe is a critical factor in full structural survey costs, as more intricate properties necessitate additional time and resources.

Booking and scheduling are equally important. It is imperative to reserve a surveyor in advance to guarantee availability, particularly during high-demand periods. The surveyor will need access to the property, necessitating coordination with the seller or estate agent to schedule a convenient time.

Report Delivery Timelines

Report delivery timelines differ based on the survey type and the surveyor’s workload. Typically, a homebuyers survey report is delivered within 2-3 working days. Conversely, a full structural survey report may take longer, usually 4-5 working days. The report offers a comprehensive analysis of the property’s condition, identifying any defects or issues that could influence full structural survey costs.

Several factors influence the timeframe, including the property’s size and complexity, the surveyor’s experience and workload, and the report’s level of detail. By grasping these factors and planning effectively, homebuyers can facilitate a seamless and efficient survey process. This, in turn, aids in managing full structural survey costs.

| Survey Type | Timeframe | Report Delivery |

|---|---|---|

| Homebuyers Survey | 1-2 hours | 2-3 working days |

| Full Structural Survey | 2-4 hours | 4-5 working days |

Property Types and Their Survey Requirements

Diverse property types necessitate distinct survey requirements. Grasping these needs is vital for a thorough survey, tailored to the property’s specific demands. For example, period properties and listed buildings necessitate detailed surveys due to their historical significance and age. Such properties often conceal hidden defects, which a meticulous survey can uncover.

A property survey offers crucial insights into a property’s state. It is imperative to consider the survey requirements for various property types. Modern homes and new builds might need less detailed surveys, whereas unusual constructions and conversions demand specialized assessments. The goal is to align the survey with the property’s unique needs.

Period Properties and Listed Buildings

These properties require detailed surveys due to their historical importance and age. The survey must evaluate the property’s condition, highlighting any defects or issues. This ensures a comprehensive understanding of the property’s state.

Modern Homes and New Builds

Modern and new constructions generally require less detailed surveys, given their adherence to contemporary standards and lower risk of hidden defects. Nonetheless, it is crucial to consider the survey requirements to guarantee a comprehensive assessment.

Unusual Constructions and Conversions

Unusual constructions and conversions necessitate specialised surveys due to their unique challenges and risks. The survey must assess the property’s condition, including any defects or issues, and evaluate its suitability for its intended use.

By understanding the survey requirements for different property types, buyers can make informed decisions, avoiding potential pitfalls. Whether considering a period property, a modern home, or an unusual construction, a detailed survey is invaluable. It provides essential insights, aiding in the selection of the right property.

Understanding Survey Reports and Findings

Grasping the essence of survey reports and findings is paramount. These documents offer a comprehensive analysis of a property’s state, pinpointing any defects or issues. They serve as a cornerstone for homebuyers, enabling them to make well-informed decisions regarding their investment.

Typically, a survey report delineates the property’s condition, cataloging both significant and minor flaws. It highlights the need for repairs or maintenance, thereby equipping buyers with a thorough understanding of the property’s status. To effectively navigate survey reports and findings, consider the following critical aspects:

- Survey reports are detailed examinations of the property’s condition

- Reports include information on defects or issues

- Reports provide recommendations for repairs or maintenance work

By comprehending survey reports and findings, homebuyers can make well-informed decisions. It is imperative to meticulously review the report and pose any necessary inquiries.

| Survey Report Type | Information Included |

|---|---|

| Homebuyers Survey | Condition of the property, defects or issues, recommended repairs |

| Full Structural Survey | Detailed examination of the property’s structure, including any major or minor defects |

Common Issues Identified in Both Survey Types

In the realm of property surveys, several common issues emerge across both Homebuyers Surveys and Full Structural Surveys. These common survey issues significantly affect a property’s value and safety. A survey by Petty Son reveals prevalent concerns such as structural integrity, dampness, and the assessment of building services.

Key issues identified in both survey types encompass:

- Structural concerns, such as cracks and subsidence

- Damp and moisture problems, such as rising damp and condensation

- Building services assessment, including electrical and heating systems

Addressing these common survey issues is crucial for ensuring the property’s safety and quality. Identifying these issues early allows buyers to make informed decisions, thereby avoiding future costly repairs.

Understanding the common issues in both survey types empowers property buyers to ensure their property’s safety and security. Collaborating with a qualified surveyor is essential to identify potential issues and address them before they escalate into major problems.

| Issue | Description |

|---|---|

| Structural Concerns | Cracks, subsidence, and other structural issues |

| Damp and Moisture Problems | Rising damp, condensation, and other moisture-related issues |

| Building Services Assessment | Electrical, heating, and other building services |

Making Your Decision: Which Survey Suits Your Needs

When choosing a survey, it’s crucial to consider the property’s location, type, and age. This information is vital in determining the most suitable survey for your needs. For instance, if you’re purchasing an old property, a more comprehensive survey might be necessary to identify potential issues.

A key factor in choosing a survey is understanding the benefits and limitations of each type. You should consider what you want to achieve with the survey and what information you need to make an informed decision. Some surveys provide a general overview of the property’s condition, while others offer a more detailed analysis.

- Property location and type

- Age and condition of the property

- Level of detail required

- Cost and budget constraints

By taking these factors into account, you can make an informed decision and select the most suitable survey for your needs.

It’s crucial to remember that choosing a survey is a critical step in the property buying process. The right survey can provide you with the information you need to make a confident decision and avoid potential pitfalls.

Working with Surveyors: Tips and Best Practices

Understanding the role of surveyors in the property buying process is paramount. Selecting a qualified surveyor is critical for a thorough assessment of the property’s condition. This ensures a comprehensive understanding of the property’s state. Effective communication and a grasp of their expertise are essential when collaborating with surveyors.

When selecting surveyors, consider their qualifications, experience, and communication style. Opt for a surveyor who is a member of a reputable professional body, such as the Royal Institution of Chartered Surveyors (RICS), Chartered Institute of Building (CIOB) or Residential Property Surveyors Association (RPSA). This guarantees adherence to strict standards, instilling confidence in their abilities.

Choosing a Qualified Surveyor

To identify a qualified surveyor, seek referrals from trusted sources or your estate agent. Online searches can also yield suitable professionals, with credentials and client reviews to verify their competence. Clear communication is vital to ensure a mutual understanding of the survey’s outcomes and any subsequent recommendations.

Communication Guidelines

Effective communication is crucial when engaging with surveyors. Pose questions and request clarification on any survey aspects that perplex you. A proficient surveyor will elucidate their findings and offer guidance on necessary repairs or maintenance. Collaborative efforts with your surveyor will guarantee a thorough grasp of the property’s condition, facilitating an informed purchase decision.

Adhering to these guidelines ensures a fruitful collaboration with surveyors. Prioritize the selection of a qualified surveyor, foster open communication, and inquire to comprehend their assessments fully. With a competent surveyor, navigating the property acquisition process becomes more confident, enabling a well-informed decision regarding your desired residence.

Conclusion: Making an Informed Choice for Your Property Purchase

Buying a property necessitates an informed choice. The distinction between a Homebuyers Survey and a Full Structural Survey is pivotal. Each survey type has its own scope, depth, and professional requirements. Understanding these aspects ensures a well-informed decision, safeguarding your investment.

Property surveys offer crucial insights into a building’s condition. They identify potential issues, enabling you to make an informed decision. Whether the property is a period home, a modern dwelling, or an unusual conversion, the right survey provides the confidence to proceed or renegotiate terms.

An informed property purchase transcends the initial survey cost. It’s about making a sound investment that secures your financial future. Collaborating with a qualified surveyor and adhering to best practices simplifies the survey process. This approach ensures a decision that meets your needs and budget.

Most clients opt for the Full Building Survey, rather than the HomeBuyers Report because the former is more in-depth and the price difference is fairly marginal.

FAQ

What is the difference between a homebuyers survey and a full structural survey?

A homebuyers survey is a level 2 assessment, offering a moderate examination of the property’s condition. It identifies any potential defects. Conversely, a full structural survey, classified as level 3, undertakes a comprehensive evaluation of the property’s structure and condition.

What are the benefits of a homebuyers survey?

A homebuyers survey provides several advantages. It uncovers most issues with the property’s condition, offering a moderately detailed report on its overall state. It also highlights necessary maintenance or repair work. This information aids buyers in making informed decisions and negotiating the purchase price.

When is a full structural survey essential?

A full structural survey is crucial for older properties, those with a history of structural issues, or with unusual construction. It offers a thorough assessment of the property’s structural integrity. It can reveal hidden defects or problems not apparent in a standard homebuyers survey.

What professional qualifications are required to conduct a full structural survey?

To perform a full structural survey, the surveyor must be a chartered surveyor with expertise in building surveying. This ensures the survey meets the highest standards, adhering to RICS, CIOB or RPRSA guidelines and standards.

How do the costs of a homebuyers survey and a full structural survey compare?

The cost of a homebuyers survey varies, typically between £600 to £1,500, influenced by location and property type. In contrast, a full structural survey is more expensive, often ranging from £700 to £2,500 or more, based on the property’s size and complexity.

What are the common issues identified in both survey types?

Common issues in both surveys include structural concerns, such as cracks or subsidence. Damp and moisture problems are also frequently identified. Additionally, issues with the building’s services, like electrical or heating systems, are common, although surveyors only give a cursory check on these and do not perform tests which are to be carried out by specialists like certified electricians and plumbers.

How can I choose the right survey for my property purchase?

The choice of survey depends on the property’s location, type, and age. A homebuyers survey might suffice for modern, well-maintained properties. However, a full structural survey is advisable for older, complex properties or those with structural histories. Consider the property’s specific needs and your budget when deciding.

What are the best practices for working with a surveyor?

When engaging a surveyor, select a qualified, RICS-accredited professional. Clear communication and collaboration are essential for a thorough survey. Being present during the inspection allows for questions and additional information sharing.